Quick access to all resources mentioned on this website

Education is key when it comes to understanding how to best live with, and manage, myeloma. Our goal is to provide you with the information and tools you need to become an informed and active participant in your healthcare.

Myeloma Canada publications cover every aspect of myeloma. Our educational resources are created specifically for people living with myeloma, their caregivers, family, and friends. In our effort to be as comprehensive as possible, we also provide publications from associations affiliated with Myeloma Canada.

All Myeloma Canada publications are free of charge and available to download, and most are also available in printed versions.

Publications and digital resources

Explore resources that will help you understand myeloma and related disorders, and support you in navigating your day-to-day life.

Digital resources

The increase in treatment options for people living with myeloma over the last 15 years is exciting and inspiring. However, in Canada, access to these treatments as well as drug coverage varies from province to province. Finding out which treatments are available and covered in your province or territory can be confusing and sometimes overwhelming.

To simplify finding the drug coverage information you need, Myeloma Canada has designed the Myeloma Drug Access Navigator tool. See, at a glance, the drugs that are available and covered broken down by province and territory.

To help you manage, track, and organize your journey with myeloma, download Myeloma Canada’s award-winning Myeloma Monitor application. The Myeloma Monitor is available as a free download for your desktop or mobile device.

Your life doesn’t stop because you have myeloma.

Discover tools and tips on ways of coping, managing, and living with myeloma. My Life. My Myeloma. is Myeloma Canada’s centralized resource centre that features management tools, downloadable guides to help facilitate conversations with your healthcare team, inspiring personal stories, and more.

Access a database of clinical trials to find the one(s) that may be right for you based on disease stage and condition, study phase, and geography. You can also save your parameters and register to be alerted to any new trials that fit.

Publications: Handbooks, InfoGuides, InfoSheets, Guides

This handbook is often considered the most important introduction to myeloma. It provides comprehensive, accurate, reliable, and clear information and educational support on a multitude of topics, including the causes and effects of myeloma, how myeloma is diagnosed, and treatment options available in Canada. Whether you’re recently diagnosed, living with myeloma, in remission, or experiencing a relapse, this handbook is invaluable.

Like most cancers, multiple myeloma impacts more than just the person living with the disease. Caregivers experience their own set of challenges and must manage their own stress levels and energy reserves, all while supporting their loved one through treatment, managing day-to-day care, and navigating the healthcare system. If you’re supporting a loved one with myeloma, you are a caregiver—and this handbook is intended for you. Specifically created for caregivers, it provides practical information on caregiving and the importance of maintaining your own well-being.

This InfoGuide has been created specifically for people diagnosed with monoclonal gammopathy of undetermined significance (MGUS) or smouldering multiple myeloma (SMM)—also known as indolent or asymptomatic multiple myeloma—their caregivers, family, and friends. It helps you understand what these 2 conditions are, how they’re diagnosed, and how they may be managed by your healthcare team.

If you’ve been diagnosed with myeloma, you know how challenging it can be to cope with pain and fatigue caused by the disease itself, side effects related to treatment, and medical tests or procedures. Pain and fatigue make day-to-day life more difficult. Myeloma Canada’s Managing Pain and Fatigue InfoGuide is intended to help you understand, manage, and cope with myeloma-related pain and fatigue.

This InfoGuide is an invaluable resource to help you better understand myeloma bone disease and the options available for its management and treatment.

In addition to explaining the role of the kidneys, this InfoGuide discusses why and how myeloma may affect the kidney. Other topics include symptoms of kidney disease, and how kidney disease is diagnosed and managed.

Learn more about the different types of blood cells, the effects of myeloma and myeloma treatments on the blood, and the key blood tests involved in diagnosing and monitoring myeloma.

Chances are, if you or your loved one has been diagnosed with myeloma, you know how challenging it can be to find information that can help you manage your finances.Over the last 15 years, incredible research advancements have led to a significant increase in myeloma treatment options. People with myeloma are living longer than ever and, as a result, may be experiencing some unique challenges. Symptoms of the disease and side effects from treatment can affect a person’s ability to work, remain independent, and be socially involved.

This comprehensive web-based guide is designed to provide you with reliable, up-to-date information to help you better understand the financial resources available to you at the federal, provincial, and territorial level, as well as ways to self-advocate for the services you need or benefits you’re entitled to.

The guide is divided into clearly defined sections with a list of resources by province and/or territory, where applicable.

(Not available in printed format)

Myeloma Canada’s Mental Well-being and Relapse: A resource guide for people living with myeloma is designed for you and your loved ones to help support your mental health as well as help you determine how wellness strategies fit into your overall cancer treatment plan. This guide includes:

- A guide to psychosocial oncology support available in Canada

- Discussion Guide: Psychosocial support for people experiencing a relapse

Navigating myeloma in rural and remote areas comes with unique challenges. This comprehensive InfoGuide addresses these issues head-on, providing valuable insights and practical strategies tailored to the needs and experience of people with myeloma. From accessing specialized care to fostering a support network within your community, this guide aims to empower patients and caregivers alike to take charge of their myeloma journey.

Developed with individuals living with myeloma in rural areas and their caregivers, this resource is a collaborative effort with our community, created to help people more confidently manage myeloma at home- regardless of their geographic location.

Virtual care allows you to connect to a healthcare provider without an in-office appointment through alternative means such as a video chat or phone call.The Myeloma Canada Virtual Care Appointment Guide and Virtual Care Appointment Planner provide you with the information and help you may need before, during, or after your virtual care appointment to make sure you get the most out of it.

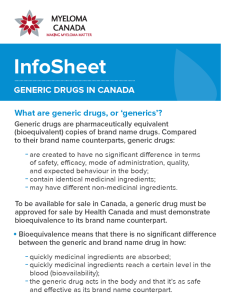

There are now generic versions of some drugs commonly used to treat multiple myeloma. This InfoSheet addresses some questions you may have, including: What are generic drugs or “generics”? How are generic drugs tested and reviewed? What if my body reacts differently to a generic drug?

Do you know what to look for?

Family physicians are often the first healthcare professional a patient will meet on their path to a diagnosis, yet most family practitioners will only see a few myeloma patients (if any) throughout their careers.

In this InfoSheet, we’ve put together answers to address some of the main questions you may have regarding what to look for in multiple myeloma. If you have questions that pertain to your specific situation, it’s always best to consult with your healthcare provider.

Other resources

Explore a selection of nutritious recipes developed by Gill Compton, a Certified Naturopathic Nutrition/Natural Chef and a myeloma caregiver to her mother.

Gill has solid expertise in developing recipes aimed at strengthening the immune system and has generously offered to help enrich our Wellness program by creating nourishing recipes specifically for our community.

Explore our exercise program in partnership with REVIVE Physiotherapy & Exercise (www.hamontphysio.ca) on our new and exciting exercise/wellness program.

Discover how to improve your fitness, activate your blood flow, and better manage the pain and side effects of myeloma and/or its treatments.

Everyone has rights that need to be respected and a voice that deserves to be heard. In our society, advocacy is essential in ensuring that your voice is not muted and that your rights are not dismissed. Learn about advocating for yourself, advocating for others, and advocating for change.

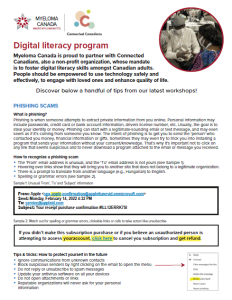

Myeloma Canada is proud to partner with Connected Canadians, also a non-profit organization, whose mandate is to foster digital literacy skills amongst Canadian adults. People should be empowered to use technology safely and effectively, to engage with loved ones and enhance quality of life.

What is phishing?

Phishing is when someone attempts to extract private information from you online. Personal information may include passwords, credit card or bank account information, drivers license number, etc. Usually, the goal is to steal your identity or money. Phishing can start with a legitimate-sounding email or text message, and may even seem as if it’s coming from someone you know. The intent of phishing is to get you to send the ‘person’ who contacted you money, financial information or gifts. Sometimes they may even try to trick you into installing a program that sends your information without your consent/knowledge. That’s why it’s important not to click on any link that seems suspicious and to never download a program attached to the email or message you received.

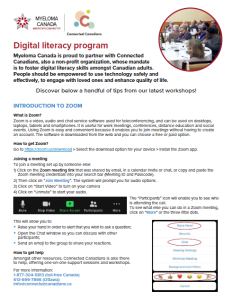

Myeloma Canada is proud to partner with Connected Canadians, also a non-profit organization, whose mandate is to foster digital literacy skills amongst Canadian adults. People should be empowered to use technology safely and effectively, to engage with loved ones and enhance quality of life.

What is Zoom?

Zoom is a video, audio and chat service software used for teleconferencing, and can be used on desktops, laptops, tablets and smartphones. It is useful for work meetings, conferences, distance education and social events. Using Zoom is easy and convenient because it enables you to join meetings without having to create an account. The software is downloaded from the web and you can choose a free or paid option.

Myeloma Canada is proud to partner with Connected Canadians, also a non-profit organization, whose mandate is to foster digital literacy skills amongst Canadian adults. People should be empowered to use technology safely and effectively, to engage with loved ones and enhance quality of life.

GETTING HELP WITH TECHNOLOGY

Understanding all the different digital tools, whether it is a computer, tablet or phone can be overwhelming. Technology keeps changing and we sometimes need help to see it clear.

Discover resources to help you understand treatment options, tests, and procedures.

Digital resources

The increase in treatment options for people living with myeloma over the last 15 years is exciting and inspiring. However, in Canada, access to these treatments as well as drug coverage varies from province to province. Finding out which treatments are available and covered in your province or territory can be confusing and sometimes overwhelming.

To simplify finding the drug coverage information you need, Myeloma Canada has designed the Myeloma Drug Access Navigator tool. See, at a glance, the drugs that are available and covered broken down by province and territory.

To help you manage, track, and organize your journey with myeloma, download Myeloma Canada’s award-winning Myeloma Monitor application. The Myeloma Monitor is available as a free download for your desktop or mobile device.

Your life doesn’t stop because you have myeloma.

Discover tools and tips on ways of coping, managing, and living with myeloma. My Life. My Myeloma. is Myeloma Canada’s centralized resource centre that features management tools, downloadable guides to help facilitate conversations with your healthcare team, inspiring personal stories, and more.

Access a database of clinical trials to find the one(s) that may be right for you based on disease stage and condition, study phase, and geography. You can also save your parameters and register to be alerted to any new trials that fit.

This Decision-Making Guide will help you map out your thoughts, emotions and information needs, to help you understand the things that are important to you in order to make a decision that you’re comfortable with.

Publications: Handbooks, InfoGuides, InfoSheets, Guides

This handbook is often considered the most important introduction to myeloma. It provides comprehensive, accurate, reliable, and clear information and educational support on a multitude of topics, including the causes and effects of myeloma, how myeloma is diagnosed, and treatment options available in Canada. Whether you’re recently diagnosed, living with myeloma, in remission, or experiencing a relapse, this handbook is invaluable.

Like most cancers, multiple myeloma impacts more than just the person living with the disease. Caregivers experience their own set of challenges and must manage their own stress levels and energy reserves, all while supporting their loved one through treatment, managing day-to-day care, and navigating the healthcare system. If you’re supporting a loved one with myeloma, you are a caregiver—and this handbook is intended for you. Specifically created for caregivers, it provides practical information on caregiving and the importance of maintaining your own well-being.

Both AL amyloidosis and myeloma result from abnormal plasma cells, a type of white blood cell produced in the bone marrow. People may have AL amyloidosis on its own or with myeloma. While some people with myeloma may also have, or develop, AL amyloidosis, it is rare for people with AL amyloidosis to develop myeloma. In this InfoSheet we’ve put together answers to address some of the main questions you may have regarding AL amyloidosis.

If you’ve been diagnosed with myeloma, you know how challenging it can be to cope with pain and fatigue caused by the disease itself, side effects related to treatment, and medical tests or procedures. Pain and fatigue make day-to-day life more difficult. Myeloma Canada’s Managing Pain and Fatigue InfoGuide is intended to help you understand, manage, and cope with myeloma-related pain and fatigue.

The goal of this InfoGuide is to help you better understand myeloma immunotherapy, how it compares to conventional myeloma therapies, and how immunotherapy uses your immune system to fight the disease. It also provides you with the names (non-exhaustive) of myeloma immunotherapy treatments in development so that you know what may be available to you for the treatment of your myeloma.

This InfoGuide helps clarify and explain the clinical trial process and answer frequently asked questions. The information provided can help with decision-making on whether a clinical trial is the right treatment option for each person’s specific situation.

This InfoGuide provides easy-to-understand and comprehensive information on high-dose therapy and autologous stem cell transplantation. It aims to clarify and explain the process as well as what to expect before, during, and after the procedure.

There are now generic versions of some drugs commonly used to treat multiple myeloma. This InfoSheet addresses some questions you may have, including: What are generic drugs or “generics”? How are generic drugs tested and reviewed? What if my body reacts differently to a generic drug?

Allogeneic SCT is characterized by the transfer of hematopoietic stem cells (graft) from a donor to another person. GVHD is a reaction following an allogeneic SCT wherein the donor’s immune system cells attack some of the recipient’s healthy cells because they are perceived as a foreign body.

In this InfoSheet, we’ve put together answers to address some of the main questions you may have regarding allogeneic SCT and GVHD. If you have questions that pertain to your specific situation, it’s always best to consult with your healthcare provider.

Palliative care is often associated with ‘end-of-life’. While this was once the case according to more traditional concepts when curative treatment was coming to an end, palliative care is now often offered after the diagnosis of a serious illness.

In this InfoSheet, we’ve put together answers to address some of the main questions you may have regarding palliative and supportive care. If you have questions that pertain to your specific situation, it’s always best to consult with your healthcare provider.

While you may have lived with multiple myeloma for some time, relapse and disease progression remain life threatening and emotionally devastating. As you navigate this stressful stage of the disease, some terms and concepts may seem foreign to you. That’s why exploring your immediate needs with your healthcare team and educating yourself on future treatment options are crucial steps in your myeloma journey. Multiple factors will influence your overall treatment plan when there’s no response to treatment (refractory) or the disease comes back (relapse).

To learn about your response to treatment and find out more about relapsed and refractory disease, Myeloma Canada has developed this InfoSheet.

Are you newly diagnosed with myeloma? Experiencing a relapse? Download the My Myeloma Discussion Guide that corresponds to your situation for important questions to explore with your healthcare team. Topics include your treatment plan, goals, sequences, and options that are best suited for you.

The My Myeloma Decision-Making Guide will help you map out your thoughts and emotions, and help you identify and understand what’s important to you as you evaluate myeloma treatment options. Making educated choices by taking into account your priorities and concerns will give you the knowledge that, together with your healthcare team, you’re making the right decision for you.

Other resources

Explore a selection of nutritious recipes developed by Gill Compton, a Certified Naturopathic Nutrition/Natural Chef and a myeloma caregiver to her mother.Gill has solid expertise in developing recipes aimed at strengthening the immune system and has generously offered to help enrich our Wellness program by creating nourishing recipes specifically for our community.

Explore our exercise program in partnership with REVIVE Physiotherapy & Exercise (www.hamontphysio.ca) on our new and exciting exercise/wellness program.

Discover how to improve your fitness, activate your blood flow, and better manage the pain and side effects of myeloma and/or its treatments.

Everyone has rights that need to be respected and a voice that deserves to be heard. In our society, advocacy is essential in ensuring that your voice is not muted and that your rights are not dismissed. Learn about advocating for yourself, advocating for others, and advocating for change.

Created in collaboration with members of the Canadian Oncology Drug Access Network, Drug Access Canada offers tools and information to healthcare professionals and patients to help them better see what medications are available and understand the characteristics of various Patient Support Programs.

Consult CAREpath’s Cancer Assistance Program to assist you in navigating through the complexities of the public healthcare system. CAREpath’s Cancer Assistance Program is designed to provide you with answers, guidance, and support.

ODANO is a provincial organization founded to provide support to and advocate for members, share resources, and educate existing and new navigators in order to maximize the appropriate funding for all cancer patients in Ontario.

Discover resources to help you understand treatment options, tests, and procedures.

Digital resources

To help you manage, track, and organize your journey with myeloma, download Myeloma Canada’s award-winning Myeloma Monitor application. The Myeloma Monitor is available as a free download for your desktop or mobile device.

Publications: Handbooks, InfoGuides, InfoSheets, Guides

If you’ve been diagnosed with myeloma, you know how challenging it can be to cope with pain and fatigue caused by the disease itself, side effects related to treatment, and medical tests or procedures. Pain and fatigue make day-to-day life more difficult. Myeloma Canada’s Managing Pain and Fatigue InfoGuide is intended to help you understand, manage, and cope with myeloma-related pain and fatigue.

Myeloma Canada’s Mental Well-being and Relapse: A resource guide for people living with myeloma is designed for you and your loved ones to help support your mental health as well as help you determine how wellness strategies fit into your overall cancer treatment plan. This guide includes:

- A guide to psychosocial oncology support available in Canada

- Discussion Guide: Psychosocial support for people experiencing a relapse

Other resources

Explore a selection of nutritious recipes developed by Gill Compton, a Certified Naturopathic Nutrition/Natural Chef and a myeloma caregiver to her mother.Gill has solid expertise in developing recipes aimed at strengthening the immune system and has generously offered to help enrich our Wellness program by creating nourishing recipes specifically for our community.

Explore our exercise program in partnership with REVIVE Physiotherapy & Exercise (www.hamontphysio.ca) on our new and exciting exercise/wellness program.

Discover how to improve your fitness, activate your blood flow, and better manage the pain and side effects of myeloma and/or its treatments.

Myeloma can present some unique financial challenges. Find resources to help you manage the financial implications of living with myeloma.

Digital resources

The increase in treatment options for people living with myeloma over the last 15 years is exciting and inspiring. However, in Canada, access to these treatments as well as drug coverage varies from province to province. Finding out which treatments are available and covered in your province or territory can be confusing and sometimes overwhelming.

To simplify finding the drug coverage information you need, Myeloma Canada has designed the Myeloma Drug Access Navigator tool. See, at a glance, the drugs that are available and covered broken down by province and territory.

Chances are, if you or your loved one has been diagnosed with myeloma, you know how challenging it can be to find information that can help you manage your finances. Over the last 15 years, incredible research advancements have led to a significant increase in myeloma treatment options. People with myeloma are living longer than ever and, as a result, may be experiencing some unique challenges. Symptoms of the disease and side effects from treatment can affect a person’s ability to work, remain independent, and be socially involved.

This comprehensive web-based guide is designed to provide you with reliable, up-to-date information to help you better understand the financial resources available to you at the federal, provincial, and territorial level, as well as ways to self-advocate for the services you need or benefits you’re entitled to.

The guide is divided into clearly defined sections with a list of resources by province and/or territory, where applicable.

(Not available in printed format)

The Canadian (federal) government administers programs that offer short- or long-term financial aid that could help if you or a loved one becomes sick and/or disabled. Provincial governments administer financial aid programs that may be of help if you or a loved one becomes disabled or if you don’t have the means and income to pay for basic living costs such as food, clothing, and shelter (social assistance).

See what may be available to you:

At some point following a diagnosis, it’s not uncommon for people living with myeloma and/or their caregivers to take time off from work or school. The amount of time you take off will depend on your specific situation, so before doing anything, it’s important to ask questions, weigh your options, and then decide what’s right for you.

Your group insurance and benefits plan booklet will outline your coverage for most services; however, coverage of prescription drugs, devices, or equipment may not be listed. Call your insurer or check your portal on their website to verify the details of your coverage. Your pharmacy may also be able to check your coverage for certain items.

Depending on the details of your specific plan, drugs, products, or devices may be partially or fully covered. Aside from the cost of the drug, product, or device in question, you may be responsible for covering other fees. Understanding the fees you’ll have to pay can help you evaluate if you’ll need extra help covering your future drug, product, or device costs.

There are 4 ways myeloma drug costs may be covered in Canada:

- The drug is on the approved list for your provincial or territorial government health insurance plan or public drug benefit program.

- Your private insurance/drug plan will pay for the drug (many private plans also have formularies or lists of covered drugs).

- The drug manufacturer will pay for all or part of the drug (if you meet certain financial eligibility criteria).

- You pay for the drug yourself (out-of-pocket cost).

Various medical expenses can be claimed on your annual income tax return as non-refundable credits that reduce your taxable income. Among medical expenses that can be claimed are travel for medical services, walking aids, wheelchairs, cancer treatment in or outside Canada, dental, medical cannabis, and laboratory procedures or services fees.

In Canada, access to treatment options and treatment coverage varies from province to province.

Myeloma drug costs may be covered by:

- provincial and territorial government public drug benefit programs

- private insurance and benefit plans offered by an employer, union, or school

- the drug manufacturer (fully or partially covered; must meet certain financial eligibility criteria)

- paying for the drug out of pocket or through a private health insurance plan

Publications: Handbooks, InfoGuides, InfoSheets, Guides

Other resources

Created in collaboration with members of the Canadian Oncology Drug Access Network, Drug Access Canada offers tools and information to healthcare professionals and patients to help them better see what medications are available and understand the characteristics of various Patient Support Programs.

Consult CAREpath’s Cancer Assistance Program to assist you in navigating through the complexities of the public healthcare system. CAREpath’s Cancer Assistance Program is designed to provide you with answers, guidance, and support.

ODANO is a provincial organization founded to provide support to and advocate for members, share resources, and educate existing and new navigators in order to maximize the appropriate funding for all cancer patients in Ontario.

All videos are available on the Myeloma Canada YouTube channel.

Navigating your life with myeloma will introduce you to a lot of new words and acronyms.

Remembering all the terms and abbreviations can be difficult and overwhelming. That’s why we’ve created an easy-to-use online glossary for you to reference whenever you need it.

Your myeloma community is one of your best resources

Myeloma touches the lives of tens of thousands of Canadians. Whether you’re living with this disease or caring for someone who is, there are community-based support groups across Canada with people who understand the journey you’re on.

In addition to our network of local support groups, there are online (virtual) Facebook support groups and peer-to-peer support programs, so you never feel alone in your journey.

Subscribe to our monthly e-newsletter, Myeloma Matters

Our monthly e-newsletter keeps you connected and informed. It provides the latest news and information on myeloma research, drug access and approvals in Canada, conferences, educational events, webinars, personal stories, local and national community news, and much more.